Now Reading: What are Future Order Type and there Uses? is it safe to use? step by step guide 2025.

-

01

What are Future Order Type and there Uses? is it safe to use? step by step guide 2025.

What are Future Order Type and there Uses? is it safe to use? step by step guide 2025.

We are going to discus about what is future order type there uses? is future trading safe to use? these are important question that many beginners want to know when they are going to trade in future and we are going to tell you all this in details.

Future Order are order that you place on a future trading platform( like binance, OKX) to put a Long or short position at a specific time and price.

in simple word: A future order type is a order that you set according to your need, time and price you can set these as you want in future order.

there are total seven order in binance that you can use and every order has different function and use, you can use them to trade in future and make money.

Types of Futures Orders:

There are many future order type but we will discus binance future orders step by step.

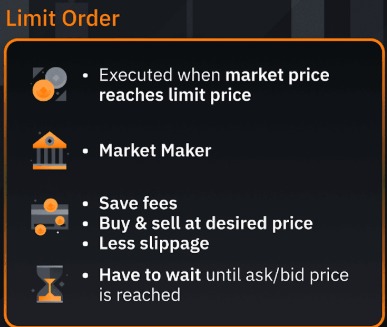

Limit order:

A limit order is to buy or sell crypto asset at a specific price or better price that you chose. Limit order is not to granted hit the amount you set.

Time:

This will only buy or sell when market hit your set amount. You need to wait for the price to surpassed your enter amount. when the price surpass the amount it automatically enter trade and give you profit or loss as the trade go.

When To Use:

After analysis, you predict the price go to a certain number and you are sure that after going at that point your coin start will going in different direction and give you profit.

Example:

Let’s say you analyze BTC chart at the current market price of 105000$ and after analyzing it, you predict it will come at 99000$ and then goes back at around 104000$, so you set the price at 99000$ when the price hit that price, it will automatically buy BTC. Some time it take little time and some time price never reach it’s target so it’s not granted, and you will not loss your money when the price don’t hit the price that you put.

Post Only Order:

A post only order is a type of limit order where it ensure that your order is placed in order book first as a maker order(not execute with a pre existing order), it did not execute order immediately as a taker.

Time:

It must be put on the order book first.

When to use:

If you want to order as a maker then use this option, because maker fees is lower then taker fees many traders use it to pay low fees and they avoided accidental market because it execute order immediately. Every trade use there own method to trade so use this option wisely.

Example:

Let’s say BTC price is at 105000$ right now.

You place a Post only order at 105000$, if it execute immediately the order will be cancel(because the will become taker order we need maker order to lower our fee)

But if you put order at 104000$ it place in order book.

there is simple reason why traders use this because it has maker order option.

Market Order:

In Market Order you can Buy or Sell your asset instantly at the current market price, you don’t need to wait or write the price to match it, just select your position and your trade instantly put at current market price.

Time:

It will process instantly. you don’t need to wait for market to come down or up if you want to sell or buy you can do it instantly.

When to use:

When you need to enter and exit market Instantly, like if you see a coin who will go up very soon and you don’t have time, you can use market order or when you see the coin is at risk and there is high chances of dumping this coin and it may give you loss, you can also instantly close it at current market price.

Example:

you want to buy a BTC current price is 105000$

You just need to select market order

put the amount that you want to trade with

select leverage and long or short position

Done, your trade will instantly start at the current market price of 105000$ BTC.

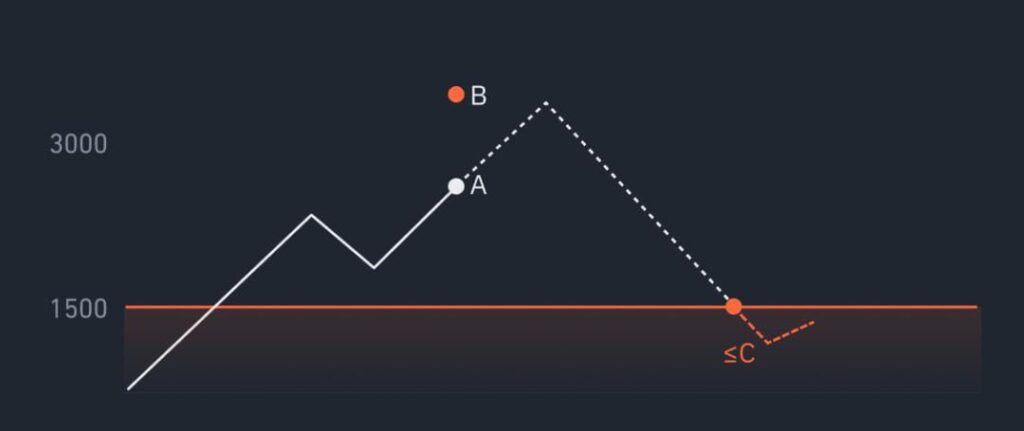

Stop Loss Order:

In stop loss Order you put a price where you want to exit the market before your trade goes in more loss, in future trading stop loss is most important order, because it can save you from a huge loss or losing all your asset so always use stop loss in future trading.

Time:

Always use stop loss order if you are a beginner(because stop loss can save you from a huge loss or losing all your asset, so always use stop loss in future trading.

When to use:

Always use stop loss order.

Example:

Let’s say you want to trade in ETH, the current price is 3000$. and you have 500$ to invest

you predict it will go up to 3200$

you use 5X leverage tp buy 3000$ worth 1 ETH.

And you also put stop loss at 2920$ for safety.

After some time for some reason the market got dump and ETH come at around 2700$ to 2600$.

If you has used stop loss you will only loss 80$ but if not then it will be 300$+ loss and some time loss did not stop only at 300$, it surpass your investing amount, so always use stop loss.

Stop Market Order:

A Stop Market order execute when specific price reached that you put, it can be used to set a stop loss or take profit order.(and also the system will automatically reject order that fail margin check or exceed position limit)

When to use:

When you want fast entry/exit and liquidation protection you can use stop market order. Stop market order has very high chance for order to execute but some time price may slip. You can use it for stop loss and take profit, and when the price hit the order will execute immediately.

Example:

Let’s say you put long trade in BTC at 105000$.

And you put a stop market at 104000$.

When the price reached 104000$ it will automatically close at market price.

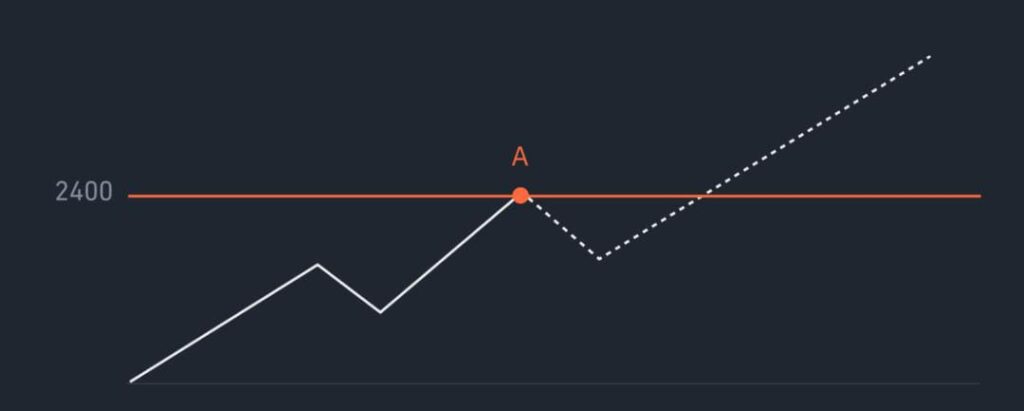

Tailing Stop Order:

Tailing stop is a order that move along with the price automatically, it’s like stop loss but in advance feature.

When to Use:

You can use it when market is moving/trending in one direction(up or down), you can make good profit with minimum risk on top of that if you use Tailing stop correctly.

How It Work:

Tailing stop order work by setting a tailing distance. like in percent 1%, price 100$ etc.

Example:

Let’s say BTC price is now at 105000$.

You set a tailing distance in price of 500$ and open long position.

You put stop loss at 104500$

If BTC price goes up at 106000$ your stop loss will also move 105500$.

And if market keep going up your stop loss will keep increasing by 500$.

If price come back down from 106000$ to 105500$ stop loss will trigger and trade will be close automatically.

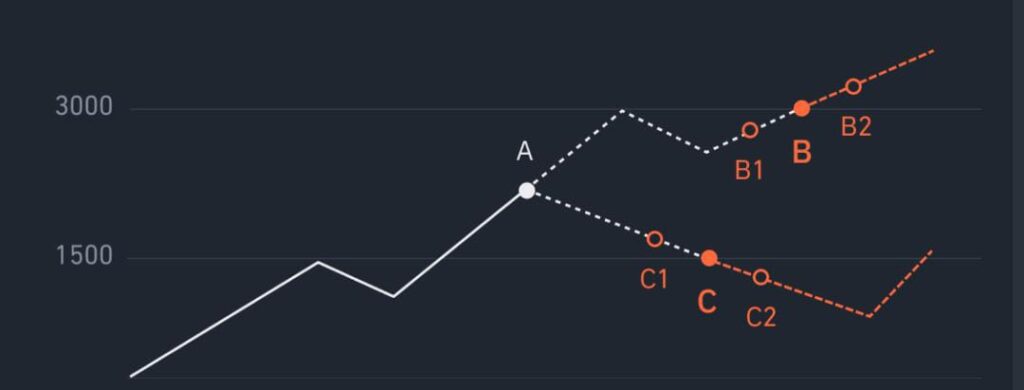

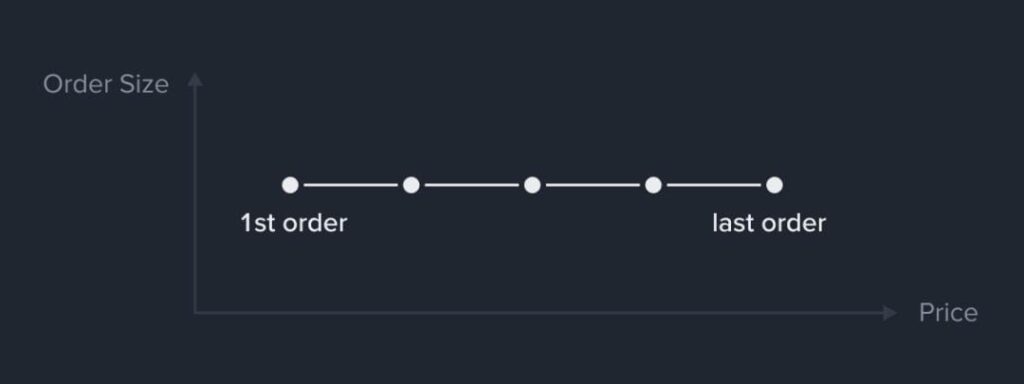

Scaled Order:

Scaled order is a order that placing multiple orders at different price level automatically.

How It Work:

It’s used to enter and exit position in parts not all at once.

When to Use:

If you want to buy or sell in parts or many orders you can use scaled order.

Example:

Let’s say BTC current price is 105000$ and you want BTC to buy in parts.

you can also sell your trade in parts.

Let’s say you open position in Long at 105000$

You can set 5 different sets like 104500$

104000$

103500$

103000$

102500$

So now you can buy more if market drop, But use it if you have good funds back up.

These are type of order in future trader, you can use it however you need.

Is Future Trading Safe To Use:

No, future trading is not safe to use, there are many people who claim that you can get total profit and never loss your money but it’s fake, you can loss your money even if you study market and analyze them. future trading is very risky to trade you can minimize your losses like you can use stop loss for safety and using risk management. if you are a beginner so start with spot trading when you master spot trading then step in to future trading because in future maybe you will earn money in start but after some time you will become greedy in some point and loss all your money.

If you want 0 loss there maybe no way but you can minimize your loss with risk management, chart analysis, trading strategy, indicators and follow the news.

this all for now if you want to know what is you need to do before starting trading then also click here.

If you want to know about what is risk management then click here.

if you want to know what is trading strategy then click here.

If you want to create binance account then click this link: https://www.binance.com/referral/earn-together/refer2earn-usdc/claim?hl=en&ref=GRO_28502_HLQT7&utm_source=default