Now Reading: What Is Spot Trading in Crypto? Step-by-step beginners guide 2025

-

01

What Is Spot Trading in Crypto? Step-by-step beginners guide 2025

What Is Spot Trading in Crypto? Step-by-step beginners guide 2025

What is spot trading in crypto and how to buy and sell in spot trading? what are the Order Type in spot trading? These are some important topic that many beginners want to understand so we will discus it step by step.

What is spot trading?

Spot trading is the simplest type of crypto trading where you just buy and sell cryptocurrency instantly at the current market price, and you own the crypto after buying it.

In more simply way to tell you thing you buy gold or silver, now when Gold or silver price increase, you will be in benefit but when there price go down you will be in loss.

| Buy crypto | You first step will be buy crypto(if you don’t have any), Let’s say you buy BTC. |

| You Own It | When you buy any crypto you will own it you, it will be store in your platform wallet. if you want to sell it you can do that any time, if you want to transfer it you also do that and instantly. |

| No leverage | In spot trading there is no leverage you trade with your own money. |

| No liquidation | if there is no leverage then there is no liquidation price you will not loss all your amount or you cannot loss more then what you actually invest. |

| Is it safe? | Yes, It is safe for beginner only if you know about what trading actually mean, you know about trading like reading chart, trends, indicators(optional), news and updates about market. |

Let’s me also show you with example what I actually mean is,

you have 1000$ and wanted to buy bitcoin.

The current market price of BTC is = 105000$

you can buy 1000$ worth BTC if you want,

you will get around 0.009523BTC at 105000$ market price.

If BTC price goes to 115000$ and you have around 0.009523BTC that you buy in 1000$.

Now if you sell it at the current price of 115000$, you will get around 1095.23$(95.23$ Profit)

but if price goes down to 95000$ now if you sell it you will get 904.76$(95.24$ Loss)

you will not loss all your amount even if BTC goes more down or up, because there is no leverage and liquidation price. this is spot trading.

What Are The Order Type In Spot Trading?

there are different Order type to buy and sell your crypto asset, when, how and in which price they want to trade it’s all available in these orders, many traders use these orders, and it’s very useful in spot trading.

1.Market Order:

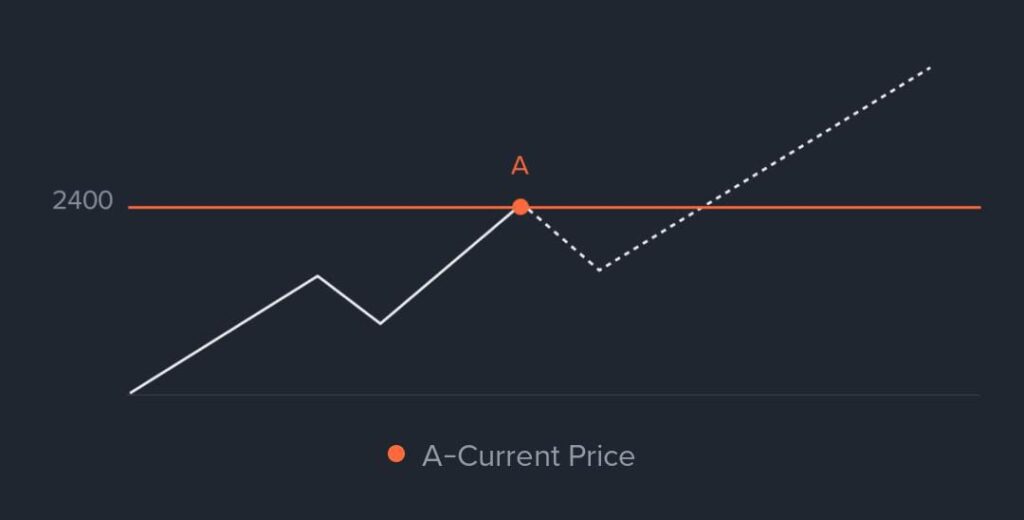

In Market Order you can Buy or Sell your asset instantly at the current market price, you don’t need to wait or write the price to match it, just buy or sell your crypto instantly at current market price.

Time:

It will process instantly. you don’t need to wait for market to come down or up if you want to sell or buy you can do it instantly.

When to use:

When you need to enter and exit market Instantly, like if you see a coin who will go up very soon and you don’t have time, you can use market order or when you see the coin suddenly come at risk and there is high chances of dumping, you can instantly sell it at current market price.

For example:

you want to buy a crypto, that coin current market price is 1.001$ and you want it instantly at that price, you just need to put how much amount you want to invest in that coin and just buy it instantly.

2.Limit Order:

A limit order is to buy or sell crypto asset at a specific price or better price. Limit order is not to granted hit the amount you set.

Time:

This will only buy or sell when market hit your set amount. You need to wait for the price to surpassed your enter amount.

when to use:

After analysis you predict the price to go a certain number and you are sure after going at that point your coin will go in different direction and give you profit.

Example:

Let’s say you analyze BTC chart at the current market price of 105000$ and after analyzing it you predict it will come at 99000$ and then goes back at around 104000$, so you set the price at 99000$ when the price hit that price, it will automatically buy BTC. Some time it take some time and some time price never reach it’s target so it’s not granted.

3.Stop Loss Order:

In stop loss Order you put a price where you want to exit the market before your trade goes in more loss.

Time:

Always use stop loss order if you are a beginner.

when to use:

Always use stop loss order.

For Example:

Let’s say you have 1 ETH the current price is 3000$ and you predict it will go up to 3200$ and also put stop loss at 2920$ for safety, Now for some reason the market got dump and ETH come at around 2700$ to 2600$, If you has used stop loss you will only loss 80$ but if not then it will be 300$+ loss and some time loss did not stop only at 300$ so always use stop loss.

Stop Limit Order:

A Stop limit order is a order that has both stop price and limit price function. When the stop price reached it automatically trigger limit price.

Time:

This will only buy or sell when market hit your set amount of limit trade or stop trade.

When to use:

After analysis you predict the price when will be the market go up and when it will come down in simple word When you know where will be the market next move is.

For Example:

you analyze the coin BTC, it’s current market price is 105000$ you predict it will first go 99000$ then come back to 105000$ again so you put stop price at 99000$ and put the limit price at 105000$, Now if the price touch 99000$ it automatically buy the BTC and when the price will hit 105000$ it will automatically sell the BTC and you will earn 6000$ with 1 BTC. And of course it is not that easy you need to predict the almost exact price for this to happen.

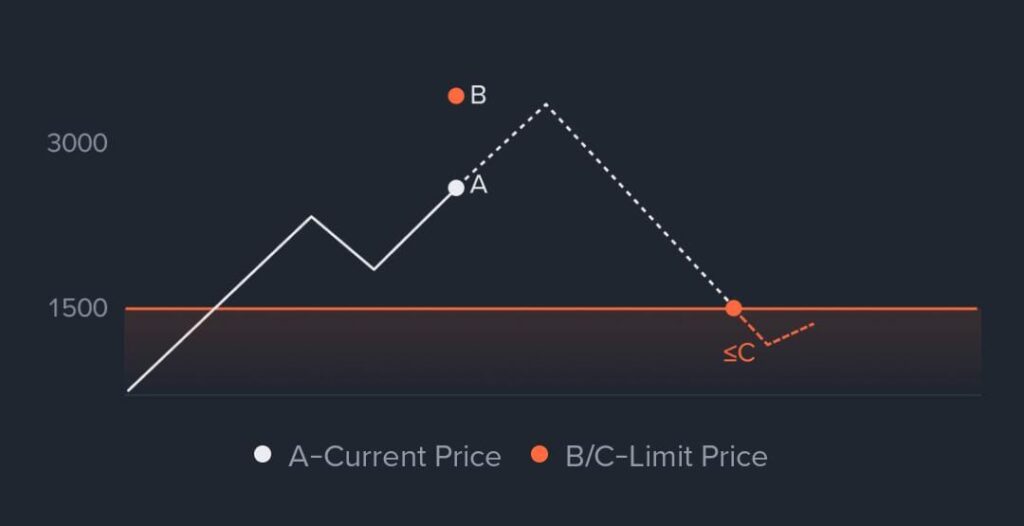

OCO(One Cancel The Other):

In OCO(one cancel the other)order contained Both stop limit order and limit order, When either one if them is trigger it automatically close the other, that’s why it’s called OCO(one cancel the other).

Time:

if you are beginner always use it.

when to use:

Try to use it in every trade if you are a beginner because it use both stop limit and limit order.

For Example:

You own 1ETH, the current price is 3000$, you analyze the ETH chart ,and analyze that it will go up to 3200$ and after hitting 3200$ it will come down. Or it will go down to 2920$, you predict that if it break 2920$ support it will dump even more so you put stop loss at 2910$ for safety and 3200$ to book your profit. Now even if coin come down after hitting 3200$ you will be in 200$ profit and even if market goes dump and hit 2700$ you will only loss 90$ if one price reached the other one will automatically canceled.

That’s all for now, if you wanted to know about binance more then click here.

If you wanted to know about what is risk management then click here.

if you wanted to know about trading strategy then click here.

If you want 10% fees discount in your binance account you can use this link https://www.binance.com/referral/earn-together/refer2earn-usdc/claim?hl=en&ref=GRO_28502_HLQT7&utm_source=default.